income tax borang b

Telefon Telephone no. Inclusive of KWSP SOCSO LHDN EIS HRDF EPF Borang A SOCSO Borang 8A Income Tax CP39 and Borang E ready.

3 BAHAGIAN H.

. A Form I-94 is needed by all visitors except. Kelulusan ejen cukai Tax agents approval no. Identification Passport No.

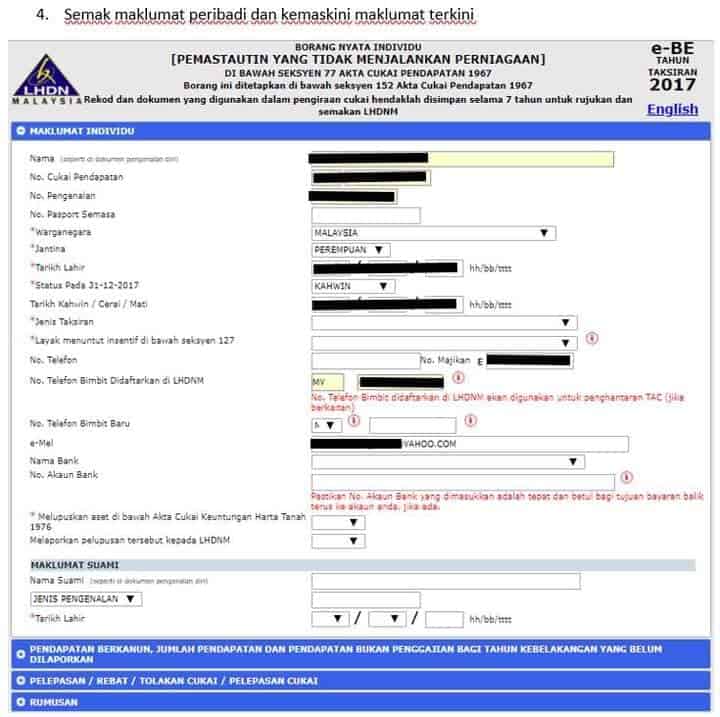

30th June 2022 is the final date for submission of Form B Year Assessment 2021 and the payment of income tax for individuals who earn business income. SQL Payroll software is ready to use with minimal setup for all companies. According to the Income Tax 1967 ITA 1967 Form EA must be given to the employees before 28th of February.

Related

很多年轻人踏入社会后对报税 Income Tax 这两个字懵懵懂懂. Some employers do not understand the content of Form EA due to language problems so we have prepared Form EA in Chinese English and Malay for employers so that employers can better fill in the Form EA. If you are filing your taxes Everything You Should Claim For Income Tax Relief Malaysia 2021 YA 2020 Jacie Tan - 12th March 2021.

Department of the TreasuryInternal Revenue Service. Visitors to find travel records. This is the income tax guide for the year of assessment 2020.

However you will be required to use the Form MMT Borang MMT instead of the Form BBE. Accountant when come to Borang B Borang BE submission a common question may ask from your customers. This guide is for YA 2020.

Form 1099-MISC is a variant of Form 1099 used to report miscellaneous income. List of Malaysian banks by Total Assets as of 31 March 2020. As a general rule if the person receiving the withholdable payment is.

Permohonan e-Daftar akan dibatalkan sekiranya tiada dokumen lengkap diterima dalam tempoh 14 hari dari tarikh permohonan dan pemohon dikehendaki membuat semula permohonan baru berserta dokumen yang lengkap. If your monthly income is RM2000 your credit limit would be a maximum of 2 RM2000 RM4000. 21 65 years old.

Enter the full name of the employee as per his or her identity cardpassport. H5 e-Mel e-Mail AKUAN PEMOHON WAKIL SAH PENTADBIR EJEN CUKAI. Total taxable gifts made before 1977 Gifts made after 1976 2.

MAKLUMAT EJEN CUKAI PARTICULARS OF TAX AGENT H1 Nama Name H2 Alamat firma Address of firm Poskod Postcode Bandar Town Negeri State H3 No. Arriving via a Land Border. Check out the what is TP Form download the latest TP1 Form TP2 form TP3 form.

Compliant with employment requirements in Malaysia. Use this revision to amend 2019 or later tax returns. In Malaysia credit card holders with income of RM36000 or less in a year are restricted to a maximum credit limit of twice of his or her monthly income.

Key in the employees income tax number in this item. Section B Use separate Form CP37 and cheque for each non-resident person to whom interestroyalty was paidcredited. Cukai pendapatan Income tax no.

Gift tax paid by decedent on gifts in column b. I-94 is a place for US. If you do not have self-employment income that is incorrect go on to item 10 for any remarks and then complete Item.

PART H. Pembayar cukai dinasihatkan untuk menggunakan pengesahan penerimaan borang nyata cukai pendapatan sebagai pengesahan status seseorang yang dikenakan cukai di Malaysia. About THE AUTHOR Alex Cheong Pui Yin.

Form 1099 is one of several IRS tax forms used to prepare and file an information return to report various types of income other than wages salaries and tips for which Form W-2 is used instead. Top largest banks in Malaysia. EIS HRDF EPF Borang A SOCSO Borang 8A Income Tax CP39 and Borang E ready.

Reporting the Credits for Qualified Sick and Family Leave Wages in Gross Income-- 01-MAR-2021. MAKLUMAT PERTUKARAN ALAMAT CHANGES IN ADDRESS B1 Alamat surat-menyurat Correspondence address Poskod Postcode Bandar. The Fair Work Commission is Australias workplace tribunal.

Bank Negara Malaysia The Central Bank of Malaysia. Section A If the payer does not have an Income Tax Number registration can be done at the nearest branch or by e-Daftar on the website wwwhasilgovmy. Paying income tax due accordingly may avoiding you from being charged tax increase court action and also stoppage from leaving Malaysia.

Pengesahan ini boleh didapati melalui perkhidmatan ezHASiL di httpsezhasilgovmy atau di cawangan-cawangan LHDNM. For ease of filing you can use ezHasil to file your taxes online. How to file your income tax.

W2 or W-2C Other specify If you do not have evidence of these earnings you must explain why you are unable to submit such evidence in the remarks section of Item 10. Totals for gifts made after 1976 Line 4 WorksheetAdjusted Taxable Gifts Made After 1976. What tax exemption or deductions are foreigners entitled to.

Citizens returning resident aliens aliens with immigrant visas and most Canadian citizens visiting or in transit. Then each subsequent Borang E filed for the rest of the employees should be numbered as 2 3 etc. LHDN Borang B.

PART B. Other specify c 1. W2 or W-2C.

Borang BBE with LHDN Acknowledgement Receipt. Non-residents filing for income tax can do so using the same method as residents. Individual Income Tax Return.

Credit limits for those earning above RM36000 are determined by the card issuers. What is Income Tax PCB TP1 form TP2 form TP3 form Malaysia. Skim Rumah Pertamaku helps young first time home buyers to obtain up to 110 financing for property purchase price up to RM300000 or up to 100 financing for property price more than RM300000 to RM500000 for their first residential home.

Latest income tax notice of assessment or latest 6 months CPF Contribution history statement. Reporting Excess Deductions on Termination of an Estate or Trust on Forms 1040 1040-SR and 1040-NR for Tax Year 2018 and Tax Year 2019 --10-JUL-2020. BORANG PEMBERITAHUAN PERTUKARAN ALAMAT SEKSYEN 89 AKTA CUKAI PENDAPATAN 1967 SEKSYEN 37 AKTA PETROLEUM CUKAI PENDAPATAN 1967.

Pengemukaan Borang Nyata BN Tahun Saraan 2021 dan Tahun Taksiran 2021 melalui e-Filing bagi Borang E BE B M BT MT P TF dan TP boleh dilakukan mulai 01 Mac 2022. Correction to the Instructions for Forms 1040 and 1040-SR-- 08-FEB-2021. We create awards approve enterprise agreements and help resolve issues at work.

July 2021 Amended US. Travelers will be issued an I-94 during the admission process at the port of entry. Gift tax paid by decedents spouse on gifts in column c 1.

SQL Payroll software is ready to use with minimal setup for all companies. Electronic submission e-Payment ready.

Borang B Atau Be Bagaimana Mengisi Borang Cukai Individu Pendapatan Bahagian 1 Borang Be Pepitih

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Due Day Extended For Personal Tax Submission 15 May 2013 E Filing

How To Step By Step Income Tax E Filing Guide Imoney

Note Jenis Borang Tax Borang B Be C E Dan P 1 Borang B Bisnes Tunggal Dan Kongsi Studocu

Swingvy On Twitter Employers Take Note Lhdn Has Extended Deadline For Form B Amp Form P Manual And E Filing Which Is Due On 31 July 2021 Instead Of 15 July 2021

Tarikh Akhir E Filing 2021 Bila Mula Isi 2022 Buka Tutup

Sayangwang Pindaan Efiling Lhdn Borang Cukai Be B

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

Cara Isi E Filing Lhdn Untuk 2020 2021 Panduan Lengkap

Tarikh Akhir E Filing 2021 Bagi Tahun Taksiran 2020

B O Tax Blog Seattle Business Apothecary Resource Center For Self Employed Women

Borang B Atau Be Bagaimana Mengisi Borang Cukai Individu Pendapatan Bahagian 1 Borang Be Pepitih

Jkkp 6 Form Fill Out And Sign Printable Pdf Template Signnow

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Borang B Cukai Pendapatan Your Tax We Care

What Is Borang Cp38 Cp38 Form Cp 38 Deduction

Lembaga Hasil Dalam Negeri Malaysia Tambahan Masa Tarikh Akhir Penghantaran Borang B Lhdnm Facebook

0 Response to "income tax borang b"

Post a Comment